Eleco continues to be well positioned in a very exciting and attractive market as technology is seen as the catalyst to meet the growing demands of the building industry. Our customer base has been facing unprecedented labour challenges and escalating materials costs.

Eleco’s software plays a crucial role in mitigating these issues, driving productivity for our customers, and enabling them to better plan their resources. There is a drive for more efficient and sustainable building methodologies and techniques. Our technology solutions are widely recognised for allowing better decision making and collaboration across our clients’ projects, positioning us to benefit from increasing digitalisation trends in our core markets.

As a result, the increasing digital transformation within the built environment is a significant opportunity for Eleco to leverage its position as a proven provider of software for the construction and built environment sectors, strengthen its platform, and continue to drive organic growth.

Purpose

To solve the challenges of the built environment through digital transformation

Mission

To provide best-of-breed software to companies in the built environment

Vision

To create certainty for the built environment

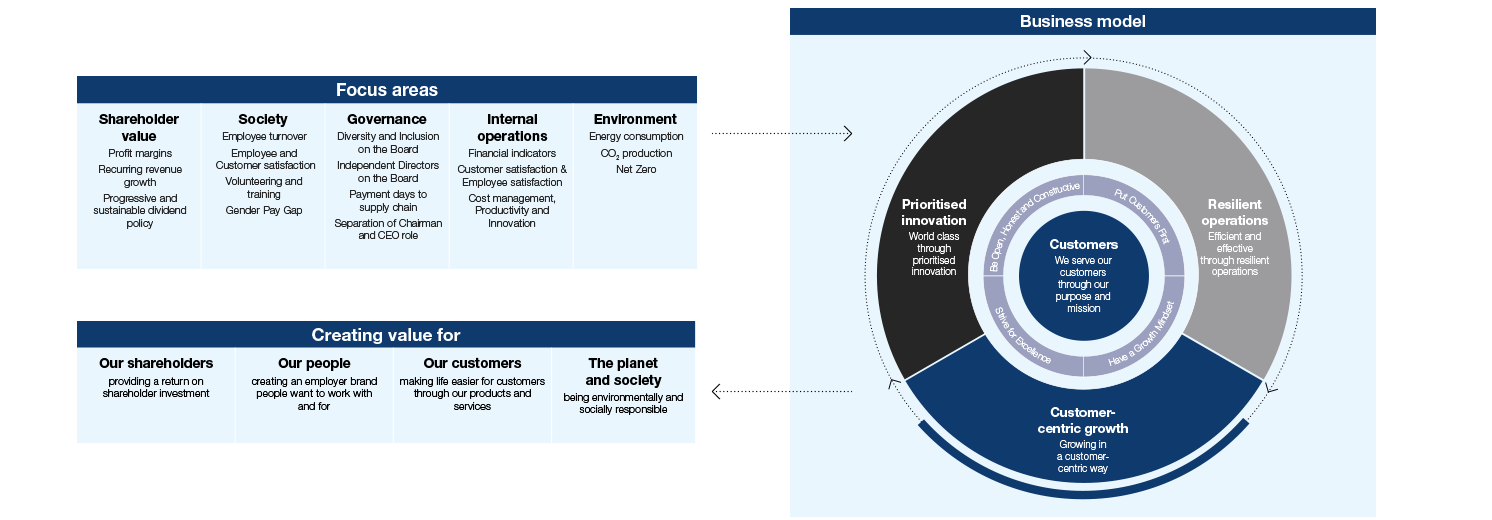

Our values and behaviours play a key part in driving through our purpose: we believe that our brand values should be reinforced by our cultural values and behaviours. As the foundation of our culture, this combination defines how we engage with those we work with and for in order to achieve value-adding impactful outcomes for:

• The planet/environment and the wider society: being environmentally and socially responsible,

• Our people: creating an organisation/employer brand people want to work with and for,

• Our customers: making life easier for our customers through our products and services,

• Our shareholders: providing a return on our shareholders’ investment.

We measure the impact of our actions through Environmental, Social and Governance (ESG) performance indicators and outcomes as well as internal operational and external shareholder value measures.

Summary of principal risks

Eleco aims to deliver sustainable growth combined with continued investment in software product development, sales and marketing resources.

The development of new products and the enhancing of existing requires continual appraisal of investments and the returns. Product development is planned, reported and reviewed frequently, and Eleco works closely with key customers and channel partners while monitoring industry trends to ensure that new products and features align to market needs and expectations.

Risk

Eleco provides digital solutions for clients and their end customer. In an environment of constantly changing customer requirements, increased technology adoption, and industry and technological innovation, there is a risk that competitors may develop solutions that are superior to ours, especially by utilising AI tools. This could result in a loss of customers and related revenue.

Mitigating actions/controls

The Head of Innovation and CTO will closely align in prioritising the development activity such that it keeps abreast of the broader technological environment, existing customer feedback, as well as existing and future competition in the building sector. Product development is tested with the market using an MVP (minimal viable product) prior to major spend commitment. Product development spend is continually reviewed to ensure that we are generating sufficient revenue or gaining a competitive advantage to justify the investment. This has been extended to include the use of AI within our own product solution roadmaps, and resourcing this. Additionally, we have entered a partnership with Nodes & Links to further embrace the use of AI.

Risk

As a technology business, Eleco places great reliance on the use of technology to operate the business; Eleco is also increasingly providing SaaS and therefore consuming globally available cloud services to ensure the greatest uptime for our customers and their end clients. There is a risk of critical IT systems being unavailable or having restricted availability to the business; there is also a risk that access to confidential data is compromised due to cyber-attacks which could lead to reduced sales, penalties and/or reputational damage.

Mitigating actions/controls

Good, effective technology risk management and close monitoring is essential to robustly handle potential IT security incidents and system failures, as well as ensuring customer information is protected from unauthorised access or disclosure. Continued investment and adhering to regulatory standards mitigates these risks. Eleco uses a multitude of cyber defence tools, including industrial-strength email- and web-filtering services, server- and end point security suites, and hardware and software firewall protection. All third-party partners used for communication, security or hosting services are protected and certified to ISO 27001 level, which includes physical as well as cyber security precautions and safeguards to mitigate against physical and cyber-attacks.

All Eleco employees receive cyber awareness training and cyber security insurance is in place to further mitigate against threats. BestOutcome and Elecosoft UK are now ISO 27001 certified.

Risk

Eleco’s employees develop and maintain our solutions, serve our customers, and provide leadership to the business. Loss of key employees or an inability to attract talent could have an impact on the Group’s operations.

Mitigating actions/controls

Eleco has won many awards for its products and has been recognised as a top performer in the market and we have obtained The Great Place to Work® accreditations in Germany, the UK and Sweden. Remaining in this space means we need to ensure we retain and continue to attract the best talent the industry has to offer. To do that we will continue to look at our employee value proposition (EVP) and benchmarking by our central HR function to build on and strengthen the arrangements that are already in place, both globally and regionally, and strike a balance between affordability, effectiveness and performance behaviours, and the desire to be a top employer within our industry. Communicating our EVP will be key to building our employer brand.

Risk

As with all international multi-product solution groups, there is a risk that the organisational structure results in siloed focus and siloed priorities between distinct business units, products, and geographies rather than collaborative efforts to reach group objectives.

Mitigating actions/controls

There are various interventions that we have already made to be strengthened: these include Group target setting and clarifying roles and responsibilities further in the matrix organisation, particularly around the key cross-cutting functions of sales and account management, marketing, product innovation and technological development and the sharing of data. In recent years, we have undertaken a number of initiatives to position the organisation for further growth including finalising the merger of our three Elecosoft UK trading entities into one Elecosoft UK Ltd entity; merging our two German CAD and Visualisation businesses into one ‘Veeuze’; disposing of the unprofitable Arcon business; liquidating old dormant entities; reviewing and enhancing our policies and procedures across the Group; and adapting our matrix structure. For example, all research and development personnel matrix reporting under the CTO as well as subsidiary MDs and also similarly now in centreline product innovation for Innovation and marketing efforts in Marketing. We are in the process of implementing and rolling out one common finance system globally across our building lifecycle business to increase transparency, improve the control environment and make enhanced data more readily available.

Work continues on the employee value proposition (EVP, employee offer) to include the design and implementation of career paths and harmonised roles across the regions which will further enable cross-fertilisation of skills and experience. This will be supplemented by people policies and procedures and cohesive learning and development approaches.

Risk

The health of domestic and global economies strongly influences elements of the built environment, such as, for example, the commercial construction business cycle. A downturn in the built environment business cycle can adversely affect Eleco’s performance. Additionally, the Ukraine and Middle East conflicts and the associated energy price rises and ongoing cost of living pressures (arising from a high inflationary and interest rate environment), may impact wider economic activity.

Mitigating actions/controls

The construction software markets are changing as the built environment accelerates its digitalisation. Eleco works closely with customers and the market risk is mitigated through operational spread between countries with plans to expand geographically both directly and through reseller partner channels.

Eleco’s position is further strengthened by servicing the maintenance stages of the building lifecycle and manufacturing, property and retail markets.

In recent times, in many jurisdictions in which the Group operates, levels of inflation, salary and other cost pressures have substantially increased, itself following the impact of the Ukraine conflict. Eleco has sought to mitigate this through geographic diversification, through BestOutcome entering new markets, not engaging directly with end consumers, and recovery of such cost base increases through price rises to its customers where possible.

Risk

The risk of failure to meet stakeholder expectations as a result of any event, behaviour, action or inaction, either by Eleco itself, our employees or partners, that may cause stakeholders to form an adverse view. The risk may not only affect revenue and resulting cost of mitigation but could also have an effect on confidence and market value.

Mitigating actions/controls

Eleco takes an active role in identifying, assessing and escalating reputational risks. Our policies aim to ensure reputational risk matters are managed in a globally consistent manner and align with our strategy. Eleco governance of reputational risk is integrated with the broader risk framework. Eleco looks to mitigate these risks by taking steps to protect against data breaches; listening to customer and employee feedback to address areas of improvement and any training needs; developing strong company values and ethics and operating on them and being aware of relevant social media adverse comments from stakeholders.

Risk

Irrespective of the fact that acquisitions made in the past have been successfully completed, the risk of conducting acquisitions and subsequent integration exists for future transactions. This includes, among other things, the inability to meet sales volume targets, and higher than expected integration costs, as well as the failure to meet any synergy goals. Furthermore, risks are present that the longer-term understanding to the business needs to be assimilated when integrated into the Group.

Mitigating actions/controls

The Group performs strong due diligence processes and closely managed integration processes; we seek to reduce the likelihood of this risk materialising. The integration plan is for the long term positioning of the acquired business in the ecosystem of the Group.

Risk

The Group earns a proportion of its revenue in currencies other than Sterling. The two largest non-UK currencies in which it trades are Swedish Krona (SEK) and Euro (EUR). Changes in these exchange rates can expose Eleco to exchange translation gains and losses.

Mitigating actions/controls

Our businesses predominantly trade in their own local currencies and have local operational and development staff cost bases which creates a natural hedge against currency movements in revenues. In addition, we will continue to monitor the need for foreign exchange contracts to manage risk where appropriate to do so.

The Group does not engage in speculative currency trading activity.

Risk

Eleco’s success is built upon the development of advanced software which requires continual protection from competitive businesses who may seek to copy or otherwise replicate the software.

Mitigating actions/controls

Eleco uses a variety of licensing technologies and defines the rights of customers in licence agreements. In addition, the Group seeks to ensure its intellectual property rights are protected by appropriate means and fully defends its rights wherever practicable.

Risk

Eleco operates across several territories and geographies which are each subject to their own laws, regulations and tax jurisdictions.

There is a risk of non-compliance which could result in fines, claims, and reputational damage.

Mitigating actions/controls

Eleco uses the services of professional advisors, who are experts in their field, to complement in-house knowledge. Transactions between group companies are carried out in accordance with Eleco’s interpretation of tax laws, tax treaties and OECD guidelines.

Eleco has many systems, processes and controls in place to ensure compliance with regulations. Intercompany transactions are conducted at arm’s length and transfer pricing arrangements remain under continued review.